The Secret’s Out

It’s no secret that black Americans have been economically suppressed for decades. From discriminatory lending practices that have kept them from accumulating wealth, to the disproportionate targeting and punishment by the criminal justice system, the economic system has consistently disadvantaged this population. This has been explicitly shown to be true in Detroit.

But there may be hope for change in the form of decentralized systems like bitcoin, blockchain technology, and other decentralized systems. These innovative systems offer a way for historically discriminated populations in Detroit and nation wide have more control over their own financial transactions and assets, bypass traditional financial institutions, and increase transparency and security.

Discriminatory Lending

Discriminatory lending practices have had a devastating impact on the ability of black Americans to build wealth through homeownership. One such practice is redlining, where financial services like mortgages are denied to certain neighborhoods based on racial or ethnic makeup. In the mid-20th century, the Federal Housing Administration (FHA) implemented redlining in neighborhoods deemed “high risk” for investment due to their racial makeup, effectively shutting out black families from the mortgage market. This lack of access to financial resources has had lasting effects on the economic stability of black families.

What’s the problem?

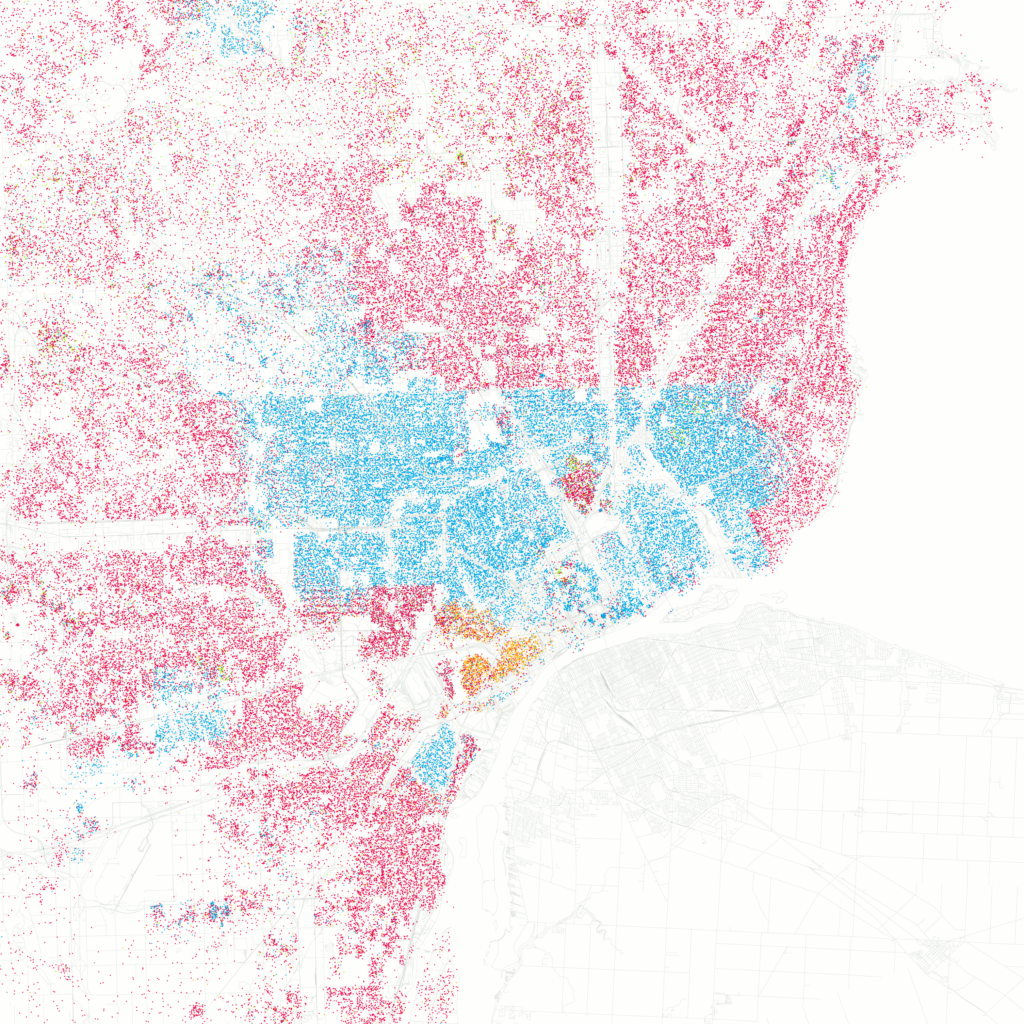

Detroit is one city where the impact of redlining can still be seen today. In the 1940s and 1950s, the FHA used a “residential security map” to determine which neighborhoods were eligible for mortgage insurance.

These maps were used by banks and other lenders to decide which neighborhoods they would lend to, and as a result, many black neighborhoods were labeled as “high risk” and were effectively redlined. This had a major impact on the ability of black families to purchase homes, as they were unable to access the same financial resources as white families.

The practice of redlining has contributed to the widening wealth gap between black and white families in Detroit. According to data from the Urban Institute, the median net worth of white households in Detroit was $171,000 in 2016, while the median net worth of black households was just $17,000. This disparity is largely due to the fact that black families have been unable to build wealth through homeownership at the same rate as white families, and has only been getting worse since the 2008 financial crisis.

In addition to redlining, black Americans have also been disproportionately affected by predatory lending practices. These are financial products or services that are marketed to people who are in a vulnerable position, often through deceptive or manipulative tactics, and are designed to extract as much money as possible from the borrower. Predatory lending practices can take many forms, such as high-interest payday loans, subprime mortgages, and auto loans with hidden fees and charges.

In Detroit, one particularly egregious example of predatory lending targeted at the city’s black population was the “rent-a-bank” scheme. This scheme, which was prevalent in the 1990s and early 2000s, involved banks partnering with non-bank lenders to issue high-interest, subprime mortgages to low-income, often minority borrowers. The non-bank lenders would then sell the mortgages to investment banks, who would bundle them into mortgage-backed securities and sell them to investors.

The scheme was called “rent-a-bank” because the banks were essentially renting their charter and regulatory protections to the non-bank lenders, allowing them to avoid state lending regulations. The non-bank lenders were able to charge higher interest rates and fees because they were not subject to the same regulations as banks.

As a result, many black borrowers in Detroit were duped into taking out mortgages with interest rates and fees that they couldn’t afford. When the housing market crashed in 2008, these borrowers were left with mortgages that were worth more than their homes, leading to widespread foreclosures and a further decline in property values in black neighborhoods.

In addition to the rent-a-bank scheme, black Americans have also been targeted by other predatory lending practices, such as high-interest payday loans and auto loans with hidden fees and charges.

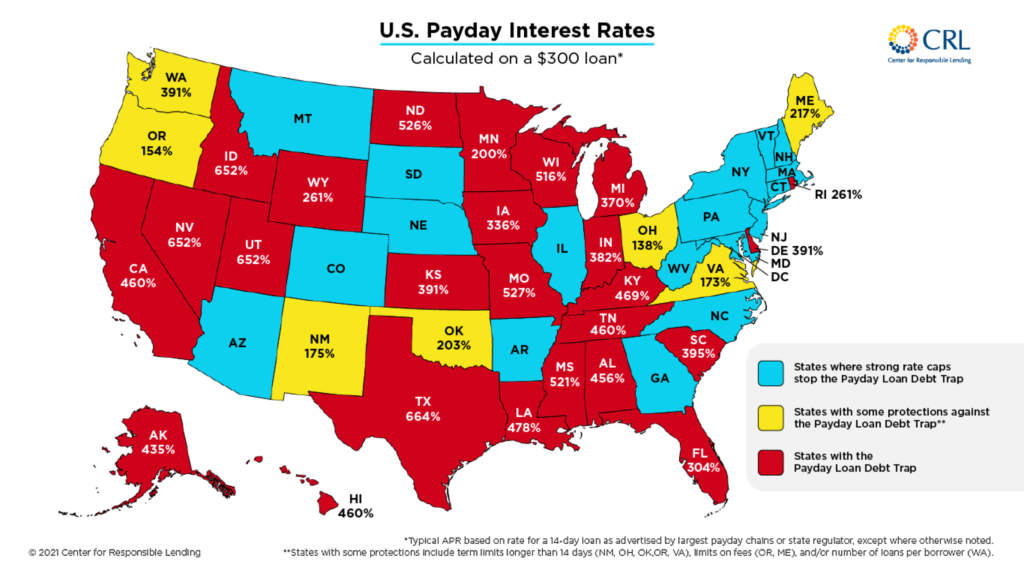

High-interest payday loans are a particularly insidious form of predatory lending that disproportionately affect black Americans. These loans, which are typically for small amounts of money and are due on the borrower’s next payday, often come with interest rates that can be upwards of 400%. This can trap borrowers in a cycle of debt that is difficult to escape, as they are unable to pay off the principal and are forced to take out more loans just to pay the exorbitant interest.

In Detroit, payday lenders have targeted black neighborhoods with high rates of poverty and unemployment. These lenders often advertise their services as a quick and easy way to get access to cash in an emergency, but the high interest rates and short repayment periods make it nearly impossible for borrowers to pay off their loans. This can lead to financial ruin, as borrowers are forced to choose between paying off the loan or paying for necessities like rent, food, and utilities.

One specific example of the harm caused by payday loans in Detroit is the story of Ken Whittaker, who fell victim to the trap of high-interest payday loans. A hardworking husband and father of six, Ken made the mistake of taking out a payday loan of $700 to cover a lost paycheck. However, he soon found that he couldn’t pay off the loan without reborrowing, leading to a cycle of debt that lasted over a year. Ken ended up paying $600 a month in fees and interest, eventually closing his bank account to stop the payday lender from taking more money. This left his family without the funds for rent, groceries, and other bills, leading to debt collection calls, a judgment, and even garnishment of his tax return. In the end, that original $700 loan cost Ken a staggering $7,000.

The high interest rates and short repayment periods of payday loans make them nearly impossible for borrowers to pay off, and they disproportionately affect black Americans.

In Detroit, these loans have caused financial ruin for many individuals and families, and they have contributed to the economic suppression of the black community.

All of these practices have contributed to the cycle of debt and financial instability that plagues many Detroiters and black Americans nationwide.

Criminal Justice Impacts

The criminal justice system also plays a significant role in the economic suppression of black Americans. Black Americans are disproportionately targeted and punished by the criminal justice system. For example, a 2022 report found that in 2019 black people in Michigan were incarcerated at a rate of 2,109 per 100,000 residents, while white people were incarcerated at a rate of 355 per 100,000 residents.

This has a devastating impact on the economic well-being of black Americans, as a criminal record can make it difficult to find employment and access financial resources. In Detroit, this has been particularly evident. The city’s history of racial segregation and discrimination has led to disproportionate rates of incarceration for black residents. This is especially true for drug offenses, where black Americans are six times more likely to be incarcerated compared to white Americans.

The high rates of incarceration also have a negative impact on black families and communities. Incarceration often leads to the breakup of families, as well as a loss of income and financial stability for those who are left behind. This can have a ripple effect, as the financial struggles of one family can impact the economic well-being of an entire community. In Detroit, the negative impact of mass incarceration has been devastating for black families and communities. The city’s high incarceration rates have contributed to a cycle of poverty and financial instability that is difficult to break free from.

Overall, the economic system has consistently disadvantaged black Americans over the past 50 years. From the discriminatory lending practices that have kept black families from accumulating wealth, to the way in which the criminal justice system disproportionately targets and punishes black Americans, the economic system has played a significant role in the suppression of this population. It is important to address these systemic issues in order to create a more equitable and just society for all.

How Bitcoin, Blockchains, and Decentralized Systems Can Help

Decentralized systems like Bitcoin can help address these economic issues by providing an alternative to traditional financial institutions that have often practiced discrimination. These technologies allow individuals to have greater control over their financial transactions and assets, with increased transparency and security through a public ledger that can’t be easily altered. This is especially helpful for black Americans who have experienced fraud or financial abuse from traditional institutions.

Decentralized Finance/DeFi

Since the recession of 2008, Detroit has been suffering from a lack of access to traditional financial institutions, particularly in low-income neighborhoods. These areas, known as “banking deserts,” have been left without the resources to safely save and invest their money. But systems like Bitcoin and decentralized finance (DeFi) offer a solution to this problem.

These innovative technologies allow individuals to have more control over their own financial transactions and assets, without the need for the intermediaries.

In addition, decentralized systems offer increased transparency and security, as transactions are recorded on a public ledger that can’t be easily altered or manipulated. This is especially beneficial for those in Detroit who have been denied access to traditional financial institutions and have faced predatory lending practices. By providing an alternative way to handle financial transactions and build wealth, decentralized systems have the potential to help close the gap and provide financial stability in underserved communities in Detroit.

Transactions on these systems are not linked to personal identification information, which can protect users from identity theft and other financial crimes. This is especially important in areas where financial fraud and abuse may be more common.

DeFi is a new way of managing financial transactions and building wealth that is not controlled by any single entity. Instead, it relies on decentralized networks and technologies like blockchain to securely and transparently facilitate financial transactions.

One of the main benefits of DeFi is that it gives financial access to individuals who may not have access to traditional financial services. This includes people who live in these banking deserts and those affected by discriminatory lending practices like redlining. In Detroit, DeFi could potentially provide a way for residents to access financial services and build wealth on their own terms.

DeFi also has the potential to provide more financial opportunities for residents of Detroit. For example, Bitcoin and other cryptocurrencies can enable individuals to participate in the global economy and build wealth through investment. DeFi can also provide a platform for small business owners to access capital without the need for traditional financial institutions.

Local Government and Banking Support

We recognize some of these areas will need input and support from local and state governments, and are not a complete solution to the issues of financial inequality and lack of access to banking services faced by many in Detroit and across America.

These systems do offer new opportunities for financial inclusion and empowerment, however.

In addition to financial literacy programs like those provided by Detroit Blockchain Center, coupling ideas like community currencies and local stable coins could unlock years of economic suppression seen in cities and towns across the Country like Detroit.

By working with local financial institutions and city governments, the adoption of decentralized finance and community currencies could be facilitated and further integrated into the lives of Detroit residents. This can provide a new way for individuals to participate in the economy and help close the gap of economic inequality that has been so prevalent.

The financial system has historically disadvantaged black Americans through discriminatory lending practices. This has had a devastating impact on the ability of black Americans to build wealth and the effects can still be seen today in cities around America. However, decentralized systems offer a new hope for change. These systems provide a way for historically excluded populations to have more control over their own financial futures, bypass institutions that won’t service them, and increase the transparency. It’s crucial to continue exploring these options and supporting the development of decentralized systems in order to create a more just and equal financial system for all.