The Basics of Blockchain Fees

If you’re familiar with blockchains and cryptocurrencies, you probably know that fees are an important part of how these networks work. But do you know why fees exist, and why they’re often so high? Here, we’ll explore the history of fees in the world of blockchains and cryptocurrencies, and discuss the risks associated with low or no-fee structures.

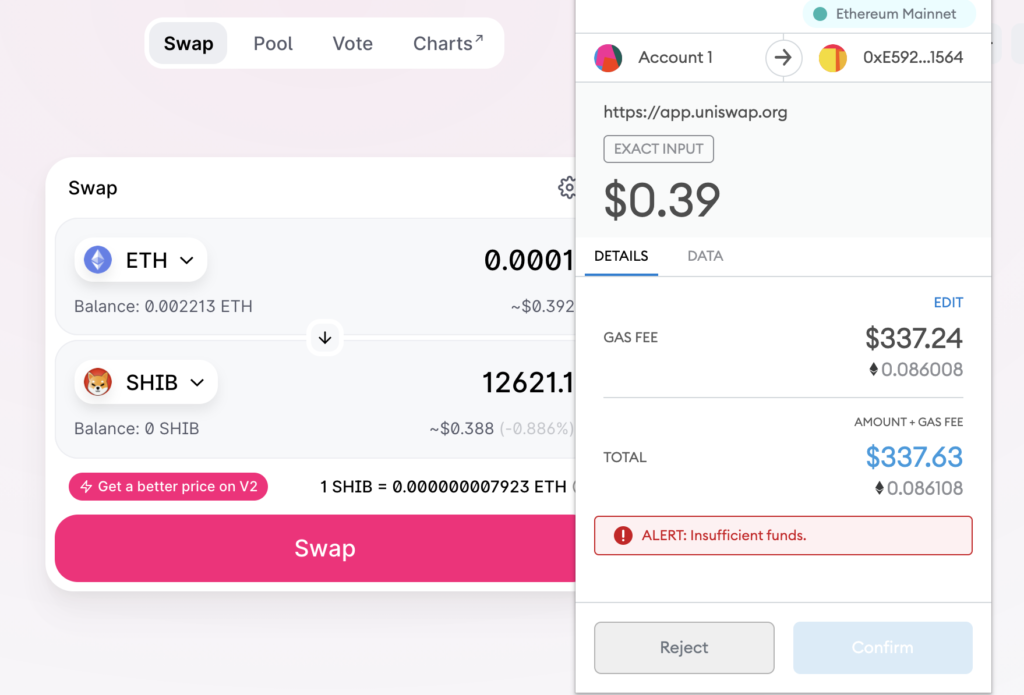

So, what are fees, exactly? Fees are sums paid by users to incentivize network participants (such as miners) to include their transactions in the next block added to the chain. It’s similar to how traditional financial systems charge fees for services like bank transfers or credit card transactions – it’s to cover the costs of providing those services.

On a blockchain, fees are used to cover the costs of running the network (think: electricity and hardware for validating transactions and adding new blocks to the chain) and to protect against spam and other malicious activity.

But unlike traditional financial systems, the fee structures in blockchains can be complex and difficult to understand. In some cases, fees are predetermined by the network, while in other cases they’re determined by supply and demand.

The History of Fees in Crypto

The concept of fees in the world of blockchains has a long and complex history. In the early days of Bitcoin, fees were minimal and often not even required. This was because the network was relatively small and there was plenty of block space to process any transactions submitted.

As Bitcoin gained in popularity though, and the network grew, it became necessary to make fees mandatory to ensure that transactions could be processed in a timely manner.

Over time, the fee structure of the Bitcoin network has evolved. In the early days, fees were optional and determined by the users themselves. But as the network grew and competition for block space increased, it became necessary to introduce more sophisticated fee structures. Today, fees on the Bitcoin network are determined by supply and demand, with users bidding against each other when block space is limited.

Other cryptocurrencies have also introduced fees over time. For example, Ethereum introduced fees in 2015 in order to combat spam attacks on the network and keep smart contracts from running indefinitely. Like Bitcoin, Ethereum’s fee structure is based on supply and demand, with users bidding against each other for block space.

The Reasons for High Fees in Blockchain Networks

In order for a blockchain network to function properly, it needs to be able to process transactions in a timely manner. This requires the network to have enough computational power to validate transactions and add them to the chain. The more transactions that are being processed, the more computational power is required. One way to increase the computational power of a network is to increase the number of nodes that are participating in the network. However, this can be expensive, as it requires the nodes to have powerful computers and fast internet connections. As a result, many blockchain networks rely on fees to incentivize miners or validators to participate in the network and help process transactions.

In proof-of-work systems, such as Bitcoin, users are required to guess massively large numbers in order to validate transactions and add them to the blockchain. This process is known as mining, and it requires a lot of computational power. Miners are rewarded for their efforts with a combination of block rewards (newly created coins) and transaction fees. In general, miners are more likely to prioritize transactions that have higher fees, as they are more profitable to process. As a result, users who want their transactions to be processed quickly may need to pay higher fees in order to attract the attention of miners, while users willing to wait a while longer can pay a lower fee.

In proof-of-stake and delegated proof-of-stake systems, users are not required to perform any computational work in order to validate transactions. Instead, they are required to hold a certain amount of the native cryptocurrency in order to participate in the validation process. In these systems, fees are typically used to incentivize users to participate in the validation process and help secure the network.

The Risks Associated with Low or No Fee Structures

While low or no fees may seem attractive to users, they can also introduce a number of risks to a blockchain network. One of the main risks is the potential for spam attacks, in which users flood the network with a large number of low or zero-fee transactions in order to overwhelm the network and prevent it from processing legitimate transactions. In some cases, these spam attacks can be so severe that they cause the network to become congested and unable to process any transactions at all. This can be frustrating for users and may lead to a loss of confidence in the network.

One example of this type of attack occurred on the Solana chain in 2022 during an NFT minting attack where bots overwhelmed the chain and caused a 5-hour outage. Solana’s focus on low fees as part of its scaling solutions make these type of attacks cheap for malicious users.

Another risk associated with low or no fees is the potential for centralization. In proof-of-work systems, miners are typically more likely to prioritize transactions with higher fees, as they are more profitable to process. If fees are too low, it may not be profitable for miners to participate in the network, which could lead to a reduction in the number of miners and an increase in centralization. In proof-of-stake and delegated proof-of-stake systems, low or no fees may also lead to centralization, as they may not be sufficient to incentivize users to participate in the validation process.

In addition to these risks, low or no fees may also impact the security of a blockchain network. In proof-of-work systems, fees are typically used to incentivize miners to help secure the network by validating transactions and adding them to the blockchain. If fees are too low, miners may not have sufficient incentives to participate in the network, which could lead to a reduction in the security of the network. In proof-of-stake and delegated proof-of-stake systems, low or no fees may also impact the security of the network, as they may not be sufficient to incentivize users to participate in the validation process and help secure the network.

As the concept of Web3 gains more traction, it’s important to understand the role that fees play in the world of blockchain. Fees exist to ensure the efficient use of limited resources and to prevent malicious activity on the network. While high fees can be frustrating for users, they are often necessary to ensure the security and stability of the network. On the other hand, low or no fees can also present risks, as they can incentivize bad behavior and make it easier for malicious actors to attack the network. It’s a delicate balance, and finding the right fee structure is crucial for the long-term success of any blockchain project.